Click to learn more about author Shweta Baidya.

Since 2015, after the birth of the R3 consortium, a number of banks and financial institutions have been focusing on exploiting the potential of Blockchain Technology. The growing emphasis can be largely attributed to the increasing need for identifying the implications pertaining to the exchanges, agreements, and consensus, among others for market infrastructure and asset management.

Blockchain has a tremendous potential for growth as it is the underlying technology for cryptocurrencies. As such, the financial sector is expected to leverage the technology in a number of ways.

According to a study on Blockchain Technologies, numerous players in the financial sector have already concluded the first phase of investment toward the development of products and services for the Blockchain field. Moreover, these players are constantly on the lookout for new investment opportunities.

The study further states that the adoption of Blockchain Technology in the financial sector is anticipated to grow at a CAGR of 38.6% over the next six years. The following chart illustrates the adoption of Blockchain Technology in the finance sector.

Collaborations on the Rise Among Technology Providers and Financial Institutions to Advance Blockchain Developments

Blockchain Technology is attracting investments from players in diverse sectors. Several technology-based companies have entered into partnerships to leverage the benefits of Blockchain. For instance, in April 2016, Microsoft Corporation (U.S.) announced its partnership with R3 with an aim to capitalize the merits of Blockchain and to provide Cloud-based services to R3 and its member banks. Similarly, Deloitte is also making use of the Blockchain Technology for auditing and reconciliation processes.

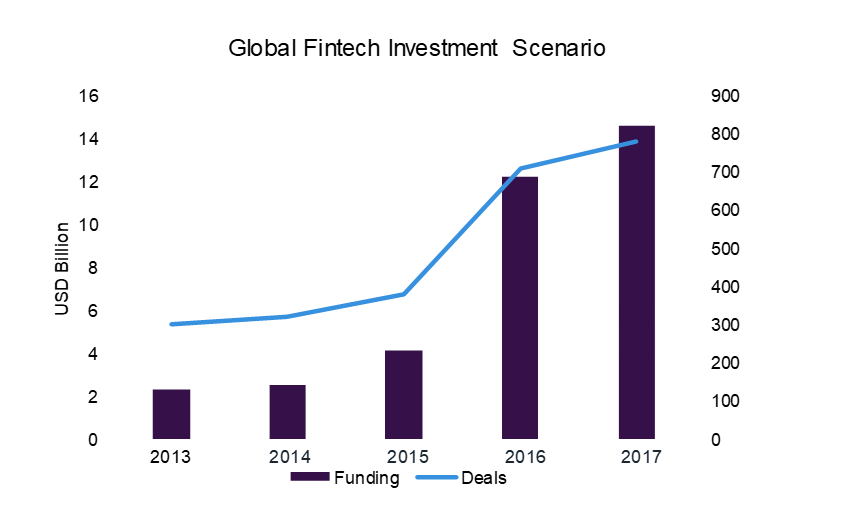

Currently, Blockchain is principally being used for the tracing and verification of transactions involving cryptocurrencies. However, it is still battling preliminary regulatory scrutiny. Over the next couple of years, Blockchain Technology is expected to witness increased investments. The diagram below depicts the investments in the financial technology segment and the number of deals made in the past few years.

The technology is expected to encounter efforts in building industry consensus. Initial seeds or proposals are also expected to be floated in the market to improve market standards. Over the coming years, Blockchain is expected to witness increased adoption in small markets but would have fewer applications in large markets.

The Most Prominent Use Cases of Blockchain in the Financial Sector Include:

- Trading Platforms: To minimize the time required for creating and delivering trade documents

- Person-to-Person Payments: To increase transparency with all the concerned parties regarding transaction details

- Currency Exchange and Remittance: To enable easy and instant exchanges between currencies

Image Credits: Grandviewresearch