The insurance industry has been traditionally conservative with technology advances and hesitant to adopt new technologies. However, times are changing, and artificial intelligence (AI) is gaining much attention from insurance companies, who are starting to realize the important role that AI can play in their operations.

AI in the insurance industry is poised to bring another wave of disruption and innovation to this $5.3 trillion global market.

According to McKinsey & Company, there’ll be 1 trillion connected devices by 2025. This will help collect tons of data to enhance the power of AI in the insurance industry even further.

Competitors are taking every possible step to claim their digital market share by investing huge amounts in digital transformation. And one of the key points in this process is how to reduce costs and expenses.

Top 5 Use Cases of AI in the Insurance Industry

Let’s look at the capabilities of AI in the insurance industry.

1. Faster Claims Processing With NLP

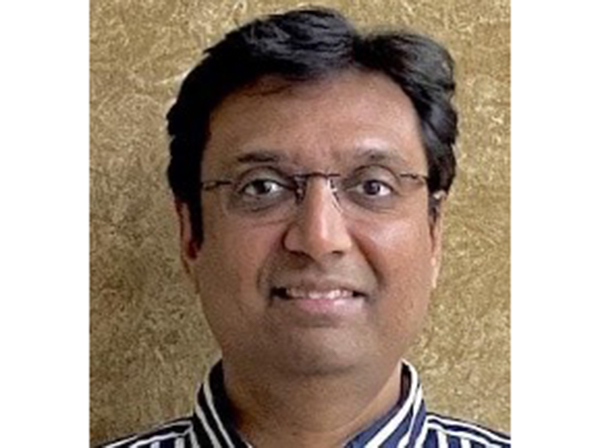

Natural language processing (NLP) refers to algorithms that can understand human speech or text from written documents and convert them into plain language or other formats.

It’s essentially a form of machine learning that enables computers to understand human language without having to write programming instructions for each word or phrase.

The claims management process can be very costly, both in terms of time and money. Up to 50%-80% of premiums’ revenues can be eaten up by this process, which is largely paper-based and rarely digitized. That’s where NLP can save resources for insurance companies.

Many industries already use NLP:

- Health care

- Manufacturing

- Finance

- Education

- Business

However, the use cases of NLP and AI in the insurance industry are still evolving.

For example, as part of its Intelligent Production platform, Swiss Re is using NLP to automate some parts of:

- Claims management processes

- Customer communication

- Underwriting

2. Rapid Document Digitization with OCR

The first step to any data analytics project is collecting and organizing your data, which can be time-consuming and tedious for large organizations.

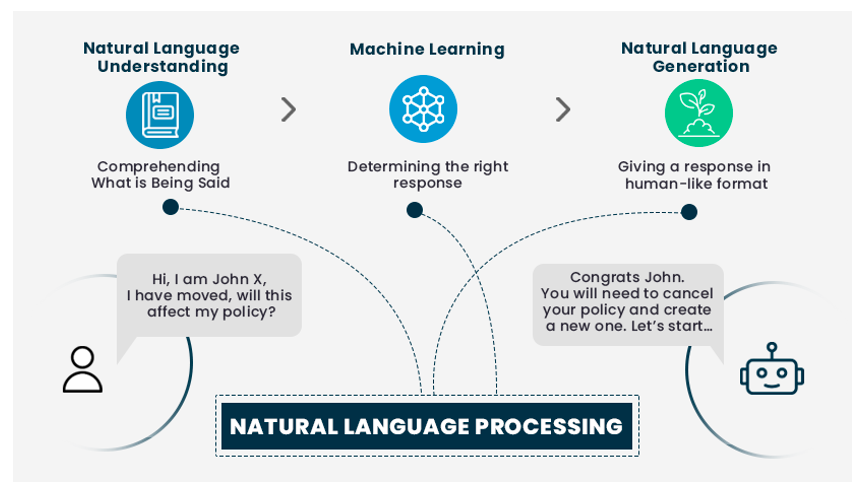

One way to automate this process is to use optical character recognition (OCR) software, which converts scanned images into text that can be easily searched by keyword or indexing software.

Image recognition is one area of AI in the insurance industry that can save a lot of money. In fact, it can drive up to 80% in cost savings for individual processes.

Some of the use cases for OCR include:

- Simplifying and speeding up tasks to improve the customer experience

- Enhancing accuracy of data processing

- Quicker customer onboarding with enhanced data processing

- Automating administrative tasks

- Better data organization and security

Here’s an example of how OCR works:

An insurer could use OCR to scan documents from claims files from multiple sources. The sources can be medical records from doctors’ offices, police reports from law enforcement agencies, or claims forms filed by clients.

Then, they input the text into a central database where it can be analyzed by machine learning algorithms and compared against other similar documents.

3. Insurance Fraud Detection and Prevention

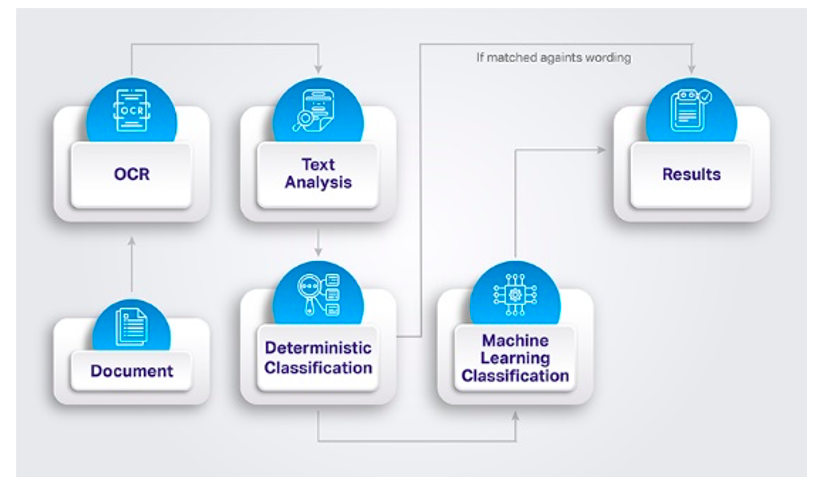

Insurance fraud is a major industry problem, but AI can help companies detect fraudulent claims before they become a significant issue.

A recent study by the Federal Bureau of Investigation revealed that insurance fraud (non-health insurance) costs U.S. insurance companies close to $40 billion annually.

AI can analyze patterns in past data and determine whether something looks suspicious. AI-powered systems can analyze thousands of data points per second and detect anomalies more accurately than humans ever could alone.

Here’s how AI can help in insurance fraud detection and prevention:

- Detecting patterns of fraudulent activity, such as policy cancellations or policy changes

- Preventing false claims before they happen by analyzing data from past claims and patterns

- Identifying suspicious behavior based on social media feeds and other sources of public information

- Recognizing forgery of vehicle ownership papers (title or registration)

- Detecting falsification of medical records to indicate more severe injuries than actually occurred

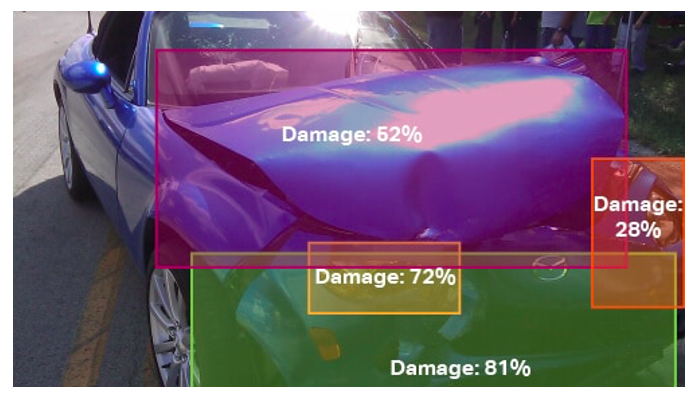

4. Accelerated Claims Adjudication with Visual Image Recognition

AI can analyze images, which makes it a valuable tool for insurance companies. Insurance claims adjusters are often asked to evaluate photos of damaged property or vehicles to determine what needs to be repaired or replaced.

Insurance companies can use machine learning to exploit behavioral data, such as facial expressions or the tone of voice, at the moment of underwriting.

This is especially common in life insurance or health insurance, where it’s been estimated that over 40% of risk information can be gathered from behavior monitoring alone.

However, human error often leads to inaccurate estimates. AI-based claims management systems can quickly and effectively process:

- Large amounts of data, including geospatial data

- Video or images

- IoT data sets

- Object recognition

- Data from a variety of sensors that monitor the environment in real time

This allows organizations to make more informed decisions about their claims processes and ultimately improve customer satisfaction.

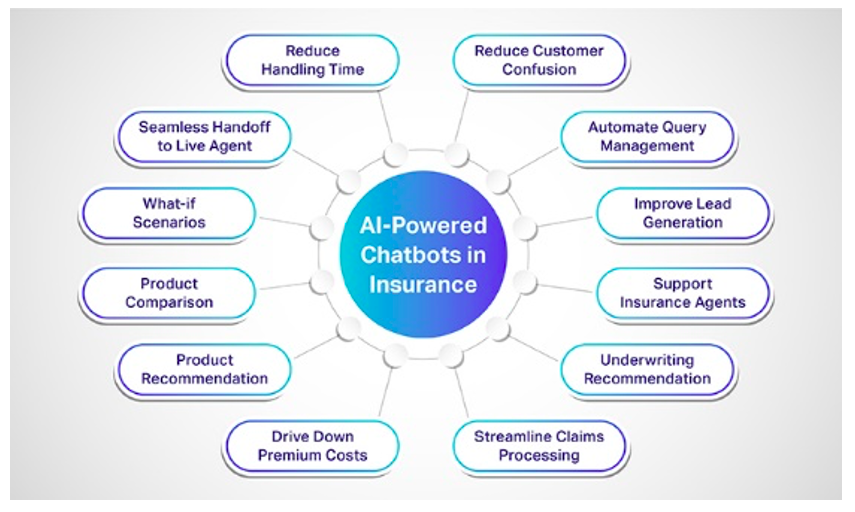

5. Improving Customer Experience

By leveraging conversational AI, insurers can automate repetitive tasks such as answering questions about policy features or claims to improve their customer experience.

AI-driven chatbots can:

- Automate routine tasks such as updating policy records or requesting a quote

- Provide 24/7 support to customers

- Cut costs by reducing the number of employees needed for customer service

- Reduce fraud attempts with automated query resolution

- Speed up the process of claim processing

Insurance companies can also use technology such as predictive text analytics that uses machine learning algorithms. They can analyze past customer conversations or unstructured data like emails or social media posts.

Conclusion

Advancements in machine learning, deep learning, and AI are making their way into the insurance industry and changing how enterprise insurance software is built. This, in turn, will help to reduce defensibility among traditional enterprise insurers and increase competition.

There’s great potential to innovate with AI in the field of insurance. That’s because the proliferation of data makes it easier to predict fraud, mitigate risk exposure, provide more personalized policies, and settle claims more quickly.